Painless Sales Tax Calculations, Reporting & Filing for eBay

Get accurate sales tax calculations and return-ready reports. TaxJar for eBay takes care of all your sales tax needs.

"Before TaxJar, I was spending six to ten hours per month on sales tax. Using TaxJar is a no-brainer for eCommerce sellers."

Features

How It Works

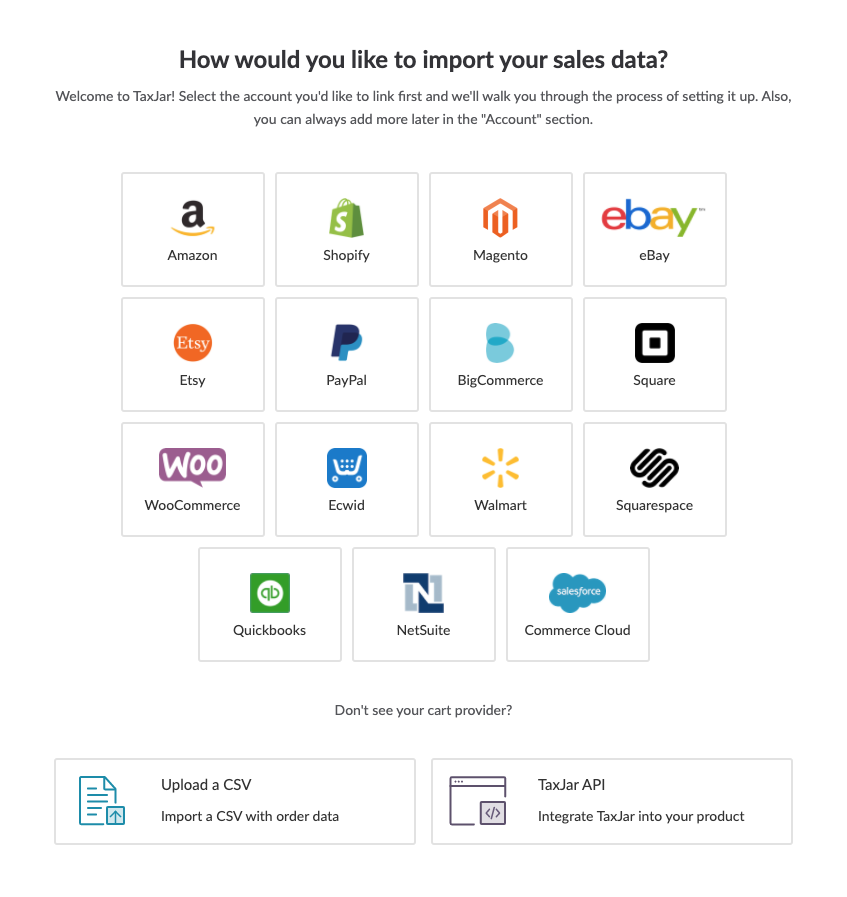

Connect to eBay with Paypal

All it takes is a few clicks to link up TaxJar to your Paypal account. We will regularly import your transactions.

You only need to do this step once! Your Paypal account is now synced with TaxJar and will update on a daily basis.

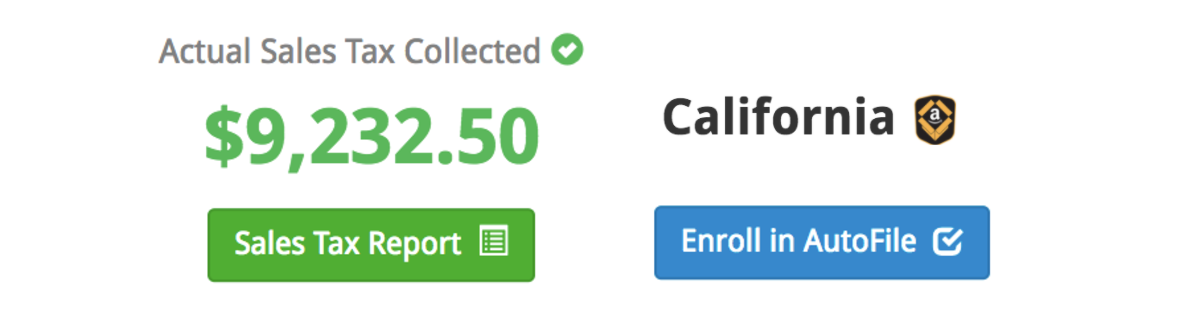

Your Tax Reports are Prepared!

Once you’re synced up to TaxJar, you’ll see your sales tax collected by city and county, across all states you owe sales tax (have Nexus). These get updated every day!

You will know if you’re collecting enough sales tax and even when your returns are due. All you have to do now is file!

AutoFile Your Sales Tax Forms

All that’s left to do now is take all the information we have broken down for you, and fill in the blanks on your tax forms!

Of course, if you want to make your life even easier, you could just let us do all the filing for you. With AutoFile, we will automatically submit your tax forms for you when they are due. This is truly sales tax on autopilot.

Trusted by More Than 20,000 Customers

Thank you TaxJar! I just finished filing California sales tax and it was a piece of cake because of the reports you provide for schedule A and schedule B. Wouldn't have wanted to do it without you!

TaxJar is one of the services I use that you’d have to wrestle away from me. It took over 2 hours to do my Florida quarterlies initially. With TaxJar, it’s about 10-15 minutes. Huge timesaver!

The first year I had to do all this sales tax by county stuff, I almost quit selling. This year with TaxJar it was almost painless. I wish I had known about them right from the start!! Worth every penny to keep your sanity!!

I did the TaxJar trial early on in my business. VERY glad I did. Subscribed without a second thought. Worth its weight in gold.

TaxJar saved me about 4-5 hours of boring, tedious, and most importantly, non-profitable work!

I just wanted to stop and say how much I appreciate TaxJar's transactions tab! The fact that I can wire several selling venues into one feed and see it all in one place and also have it downloadable as a csv file, it's awesome! Plus the ability to filter the results by date or selling venue or state! TaxJar Rocks!

I’m a CPA and wouldn’t think of running my business without TaxJar. The reports you get from Amazon are almost worse than useless, but TJ takes the hard work out of it for you.

I spend a lot less time on sales tax now thanks to TaxJar.

I had tried FBA for about 4 months. I was doing really well but stopped due to the unknown factor: sales tax. I found out about TaxJar, and with the knowledge I gained in just a few minutes I will be able to get FBA going again. No one else was able to answer my questions.

Common Questions

Feel free to contact us if you can't find the answer to your question. We're happy to help you.

TaxJar's automated reports eliminate the need for you to lookup sales and sales tax information by state, county, city, and local tax jurisdiction. We give the the exact data you need to be able to file your tax returns much faster than using Excel spreadsheets.

For many states we'll even file your sales tax returns for you. Our reports are updated every day and downloadable in CSV format. You'll also receive email reminders when your sales tax returns are due. Lastly, you'll be able to see what sales tax you should have collected using our detailed sales tax analysis feature.

Yes. With AutoFile you can file sales tax returns in most states. Learn more about AutoFile.

We sure can! This feature can be very helpful if:

- You aren't sure if you’ve set up your sales tax collection correctly.

- You have sales before you started collecting sales tax.

- You sell on multiple channels, but aren’t collecting sales tax in all of them.

- You use Fulfillment By Amazon, but aren’t collecting sales tax in some of Amazon's warehouse states.

To learn more about expected sales tax, click here.