Simplify Sales Tax Compliance for Your Online Retail Business

Start your free trial Download nexus guide

Track economic nexus in every state

Understand where your business currently has nexus, where it’s approaching nexus, and how to begin complying with state sales tax laws with the Economic Nexus Insights dashboard.

- Receive email notifications when your business is approaching state thresholds

- Get ahead of registering for state sales tax permits

- Easily enroll in AutoFile as soon as economic thresholds are met

Charge the right retail sales tax rate on every order, every time

With more than 14,000 jurisdictions, thousands of product tax codes, and 46 states enacting different sales tax laws, knowing what to charge and where is complicated.

- Track when and where you’re required to collect sales tax

- Stay sales tax compliant by charging rooftop-level rates

- Use Emmet, our AI backed tax categorization robot, to automatically classify product tax codes for you

Connect your multi-channel business to a reliable sales tax API

TaxJar has a number of certified, out of the box integrations to help you streamline your sales tax management. We build and support our integrations in house in partnership with a number of well known vendors including: Netsuite, Salesforce, BigCommerce, Amazon, Shopify, and more.

- 99.99% uptime, so your shopping cart never slows down

- Sub-18ms response time that is faster than blinking an eye (and 16x faster than our closest competitor)

- Guaranteed accuracy for rooftop-level rates so that you can stop fussing with rate tables

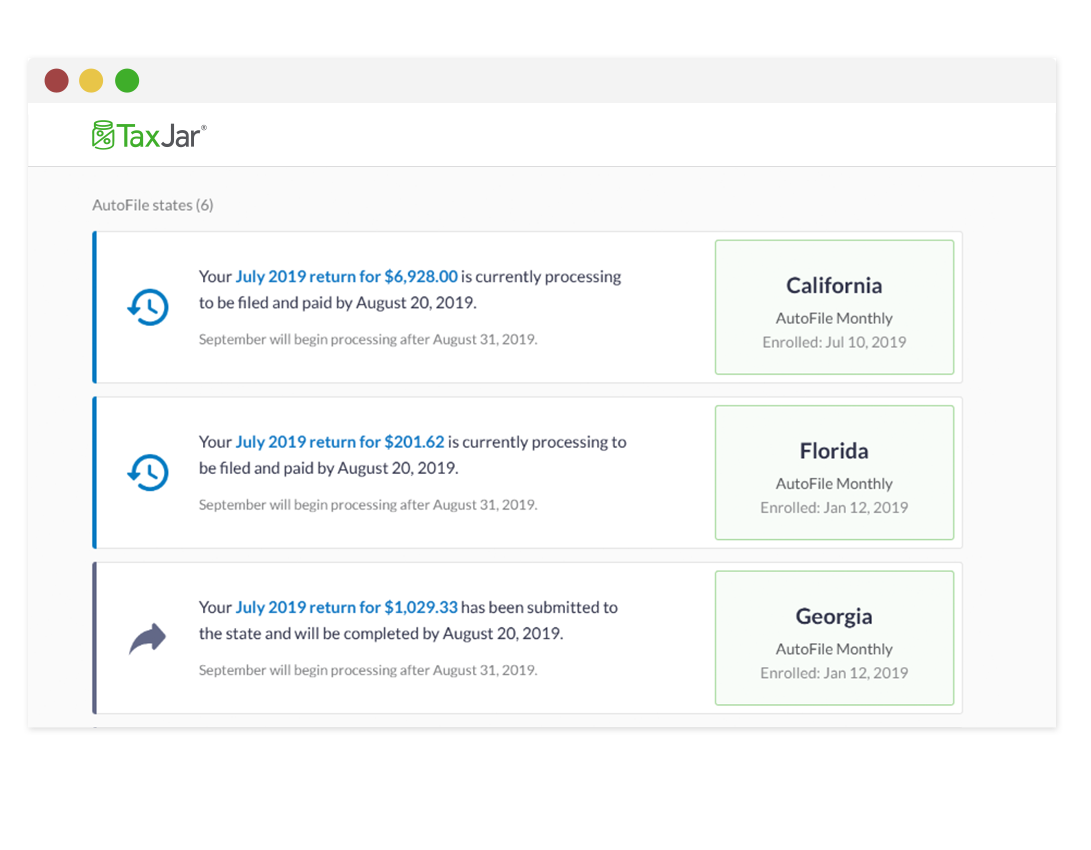

AutoFile your sales tax returns

As your business grows, so do your sales tax responsibilities. Never miss a due date with TaxJar’s automatic electronic filing service for state sales tax, which transforms your data — gross sales, sales subject to local tax, and tax collected — into tax returns for every state.

- Enroll in AutoFile for each state where you have nexus

- File returns and remit state sales tax payments automatically

- View all your sales tax return information in one dashboard

Sales tax experts at your fingertips

TaxJar’s sales tax experts are available to walk you through every step of your sales tax journey. Available by email or phone, our experts will help you navigate the sales tax landscape and provide guidance to help you get the most out of our products and solutions.

- Intelligent question routing to the right resources through the chatbot

- Search for a number of common questions and support documentation

- Get in touch with our sales tax experts

Not having to file manually in 42 states, that’s where we save a lot of time. We save money by not having to hire a full-time sales tax person.”— Vu Nguyen, Chief Operating Officer of Beautylish Read the full case study

TaxJar offers everything you need for Retail sales tax management

- Automatically calculated, accurate sales tax rates

- Pre-populated and maintained tax codes

- Economic nexus insights dashboard

- Automated state filing