Guide to Setting up Your TaxJar Account

- Last Updated

- November 15, 2016

Overview

We wrote this guide for TaxJar users to get started using their TaxJar account as soon as possible.

After reading this, you’ll know:

- How to connect your eCommerce shopping cart or marketplace to TaxJar

- Where to review your Sales Tax Reports

- How to file your sales tax returns

- How to set up your TaxJar account for optimal sales tax compliance

Connect Your Cart or Marketplace

It takes a few minutes to connect your eCommerce shopping cart or marketplace to TaxJar! When you get started, you’ll see a screen to connect your eCommerce provider like this:

Connect

Click on the icon for the cart or marketplace that you want to connect and follow the steps you see on the next page to complete the connection. Click here for provider-specific directions to get connected.

We’ll create your Reports!

After you do this, TaxJar will need between 30 minutes to an hour to import your transactions and summarize your Sales Tax Reports.

We’ll send you an email when your Reports are ready to view. In the meantime, you can take a tour of the Account here. (If we have a link to the tour)

Don’t see an icon for the cart or marketplace where you sell your products?

If you don’t see an icon to connect your cart, you can still upload your sales to TaxJar using a CSV.

a) From the Linked Accounts page, click on “Manage CSV Files.”

b) On the next page, click “Upload CSV File.”

c) Download the sample CSV file and use this file to build your CSV with the correct formatting.

d) Click “Browse” to select your file and “Upload File” to upload your CSV.

e) You can view a record of all imported files here on the CSV Imports Page.

f) TaxJar will need up to an hour to import your transactions and summarize your imported data. We’ll send you an email when your Sales Tax Reports are ready.

g) To make sure your import is successful, please be sure to follow the exact guidelines we list here:

3) Review TaxJar Reports

Once your data has been imported, it’s time to review your Reports.

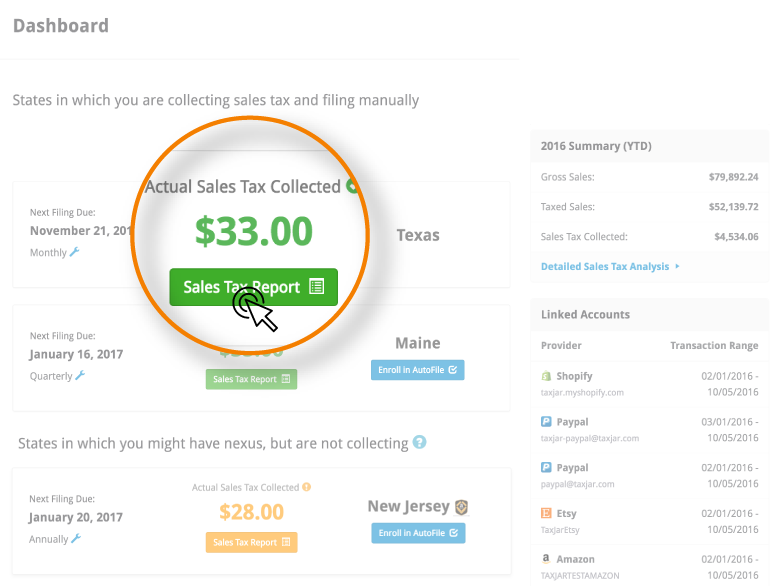

From your Dashboard, click on the “Sales Tax Report” button for the specific state you’d like to review:

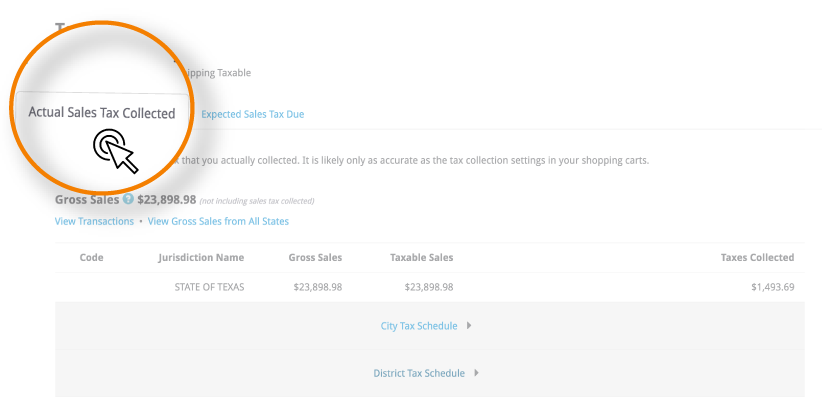

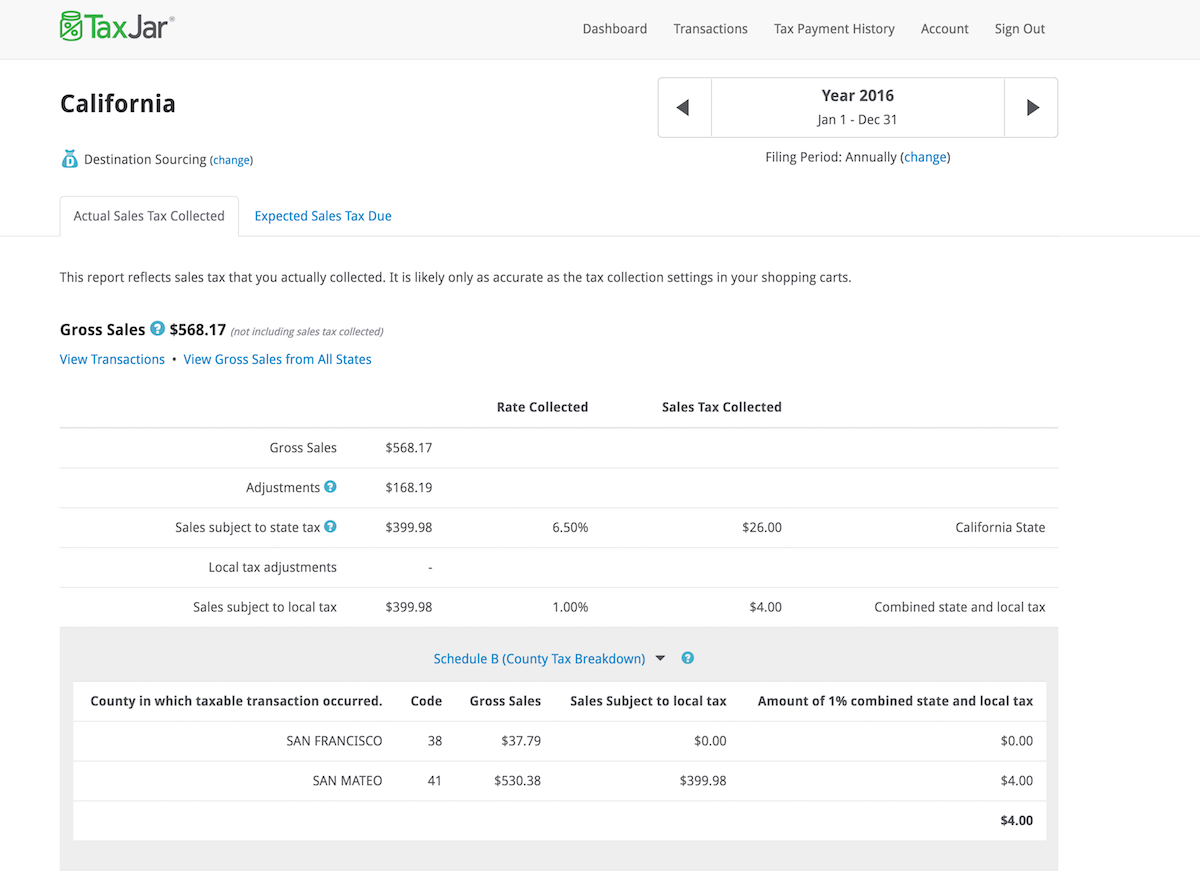

One the next page, you’ll see a Sales Tax Report that has all of the data you need to file your return with the state. Because each state’s return form is different, the TaxJar Report for each state may vary, but there are a few details you’ll find in each Sales Tax Report:

Actual Sales Tax Collected/Expected Sales Tax Due:

The Actual Report shows your gross sales, sales by jurisdiction, and the actual sales tax that you collected during this time period.

The Expected Report shows your gross sales, sales by jurisdiction andTaxJar’s estimate of the sales tax that you should have collected during this time period.

Tip: Here are some common reasons why your Actual and Estimated reports might not match.

View Transactions and Gross Sales from all states:

- Click “View transactions” to view a list of the transactions included in this Report.

- Click “View Gross Sales from All States” to see your Gross Sales total in all states

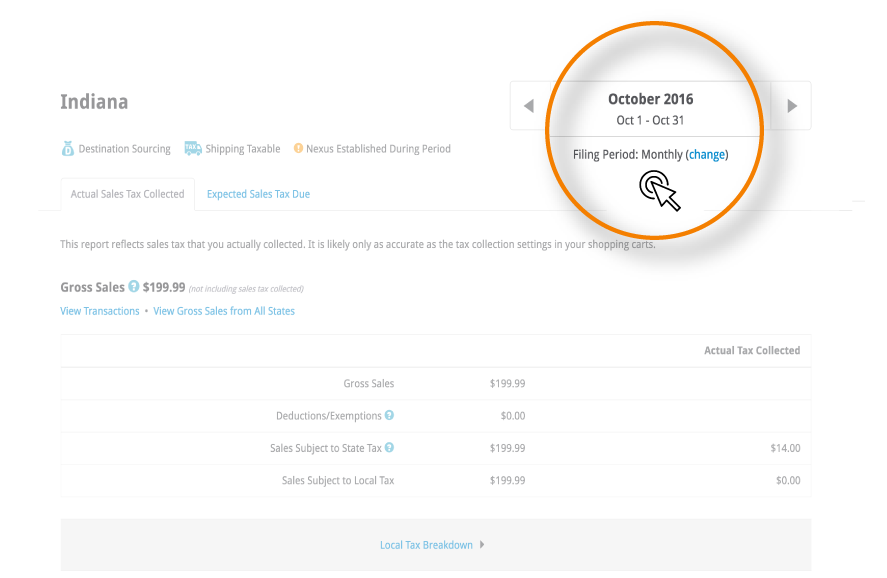

The Date Range for this Report:

- TaxJar Reports default to a monthly view of sales data

- The date you see here should match your state assigned filing frequency

- Click “change” to modify and your reports below will update accordingly. (You can also use the left and right arrows to view earlier or later Reports.)

Jurisdiction Breakdowns by City/State/County:

If the state requires you to report sales by jurisdiction, this area of your report will show these amounts.

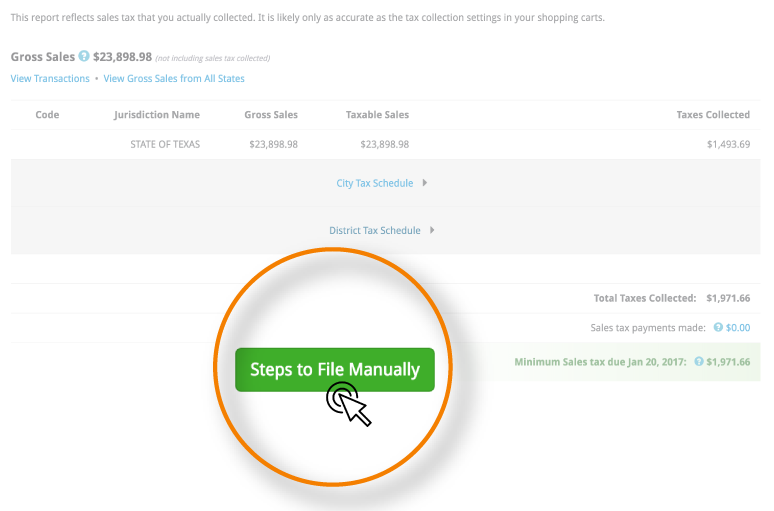

How to File Manually

Click the “File Manually” button or link to file your sales tax returns on the state’s e-file website.

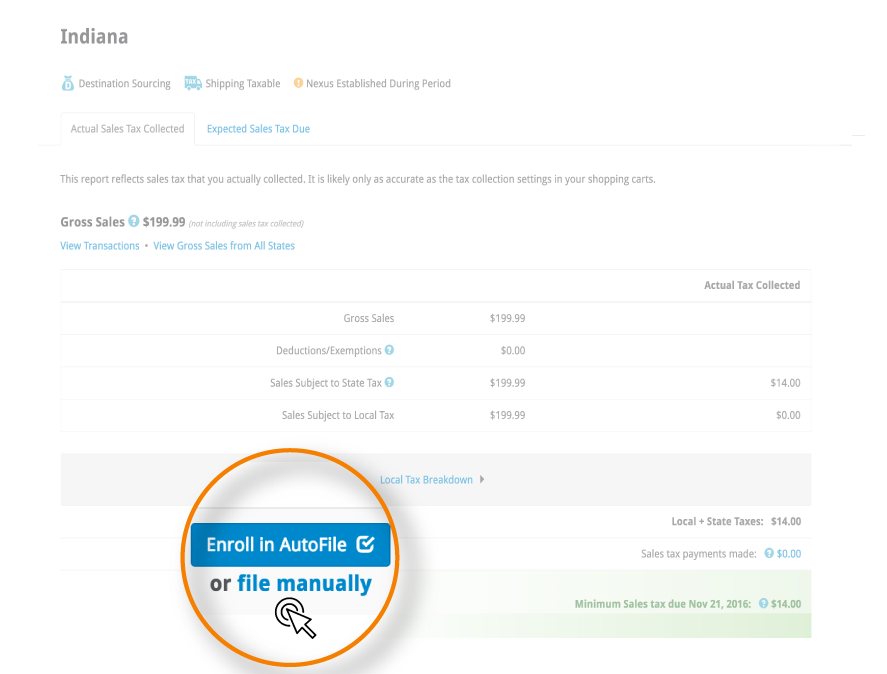

Enroll in AutoFile

If TaxJar’s automated filing is available in the state, we will also show an option to Enroll in AutoFile. Click the enroll in AutoFile button and TaxJar will file your returns automatically (in most states).

Record your payment and close the filing period

After you file your return, make sure you record the payment in your TaxJar account. This will “lock” the data in your Report and also update your Dashboard to display the next filing due date.

Where do I register to collect sales tax?

Most sellers will not need to collect sales taxes in every single state.

As a seller, you’ll need to register to collect sales taxes from all customers who live in the states where you have nexus.

“Nexus” is a term for a physical presence that’s significant enough for you to be required to comply with that state’s sales tax laws.

You’ll automatically have nexus in your home state or the state where you business is based. (Unless the state where you business is based has no sales taxes.)

The most common causes for nexus in other states are:

- Offices

- Employees

- A warehouse

- An affiliate

- Stored inventory

- Drop shipping from a 3rd party provider

- Temporarily doing physical business in a state for a trade show or craft fair

If you have those types of connections in other states, you would likely have nexus in those states in addition to your home state and we’d recommend that you check with that state’s taxing authority to confirm that you have sales tax nexus.

If you do have nexus in other states, you would then need to register to collect sales taxes from all customers in each of your nexus states as well.

Once you have have nexus in a state, you’ll collect sales taxes on all taxable items shipped to customers in the state, regardless of the state where the item is shipped from.

Need more information about nexus? Check out this blog post.

How to register for a sales tax license

Once you know where you have nexus, you’ll need to register for a sales tax license.

If you’d like to do this yourself, we have put together content that shows you how to register for a sales tax permit in any state.

If you would like to have someone else handle the registration process, we have partners who can provide this service. Fill out the Contact Form to get started and we’ll be in touch with next steps.

Complete Your TaxJar Account Setup

To make sure your account is fully set up to help you manage your sales tax compliance, we recommend doing the following steps:

1. Complete your business profile:

Complete the blank fields of your account’s Business Profile on the Account page.

2. Add your nexus states:

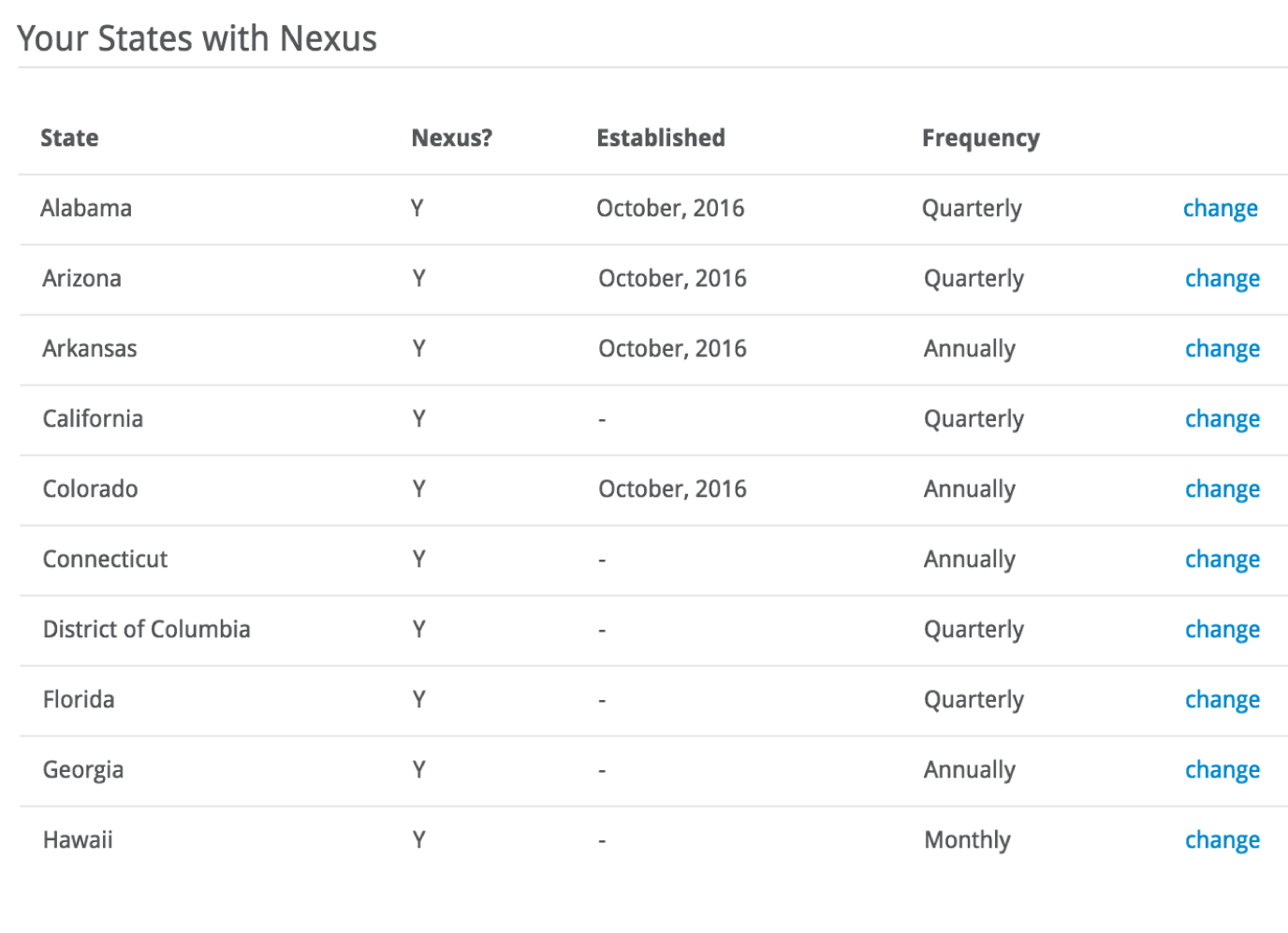

Setup your Dashboard to show you all of your nexus states and filing due dates by filling out all of the details in the State Settings, including your sales tax license registration number.

To do this, click the ‘change’ link next to the state name in your State Settings and add your sales tax registration number.

If you don’t see the state you’d like to add, click the green “Add State With Nexus” button and select the state from the menu:

3. Confirm your filing frequency:

The Sales Tax Reports you see in your account automatically default to a Monthly filing frequency, but the states themselves determine the filing frequency for each taxpayer when you register for a sales tax license.

To make sure your TaxJar Reports and your Dashboard match the filing frequency the state assigned you, always edit the filing frequency for your nexus states in the State Settings.

4. Make sure you are collecting sales taxes:

Your TaxJar Reports will reflect the amount of sales tax you’re collecting, but you’ll also need to be sure that you have enabled tax collection in your eCommerce shopping cart or marketplace.

Click your cart or marketplace below to see instructions for enabling sales tax collection:

eBay/PayPal (Video directions)

Resources

The TaxJar Blog - The latest in sales tax news (in plain language) and TaxJar updates.

TaxJar’s YouTube Channel - Video resources for TaxJar users

Sales Tax By State - Current rates, what’s taxable, how to collect, etc.

General Sales Tax Guides - Getting started, when to register for a sales tax license, consumer’s guide to sales taxes, etc.

Sales tax Guide by eCommerce cart or marketplace - Amazon, Magento, WooCommerce, Shopify, etc.

Sales Tax 101 Webinars - Video recordings of our webinars

Tax Collection Setup Guides - How to set up tax collection for your eCommerce cart

Account Connection Guides - How to connect your cart or marketplace to TaxJar

Online Sales Tax Calculator - Look up a specific rate by location

Help Center - Knowledge Base articles and FAQs