The Food and Beverage industry is changing, and so is your sales tax

Prepared foods, meal kits, specialty items, and grocery items are all taxed differently within and between states. Should you be charging sales tax? Are you charging the right rate? TaxJar keeps you compliant, even as your business innovates.

Learn more about charging sales tax on restaurant take-out orders by stateCharge the right sales tax rates, every time

Your in-store customer will pay a different sales tax rate than your eCommerce customer across the country. With TaxJar, you’ll never undercharge and owe sales tax out of pocket, or overcharge and create a poor customer experience. TaxJar’s rooftop-accurate sales tax rates ensure that you charge the right sales tax rate to the right customer, every time.

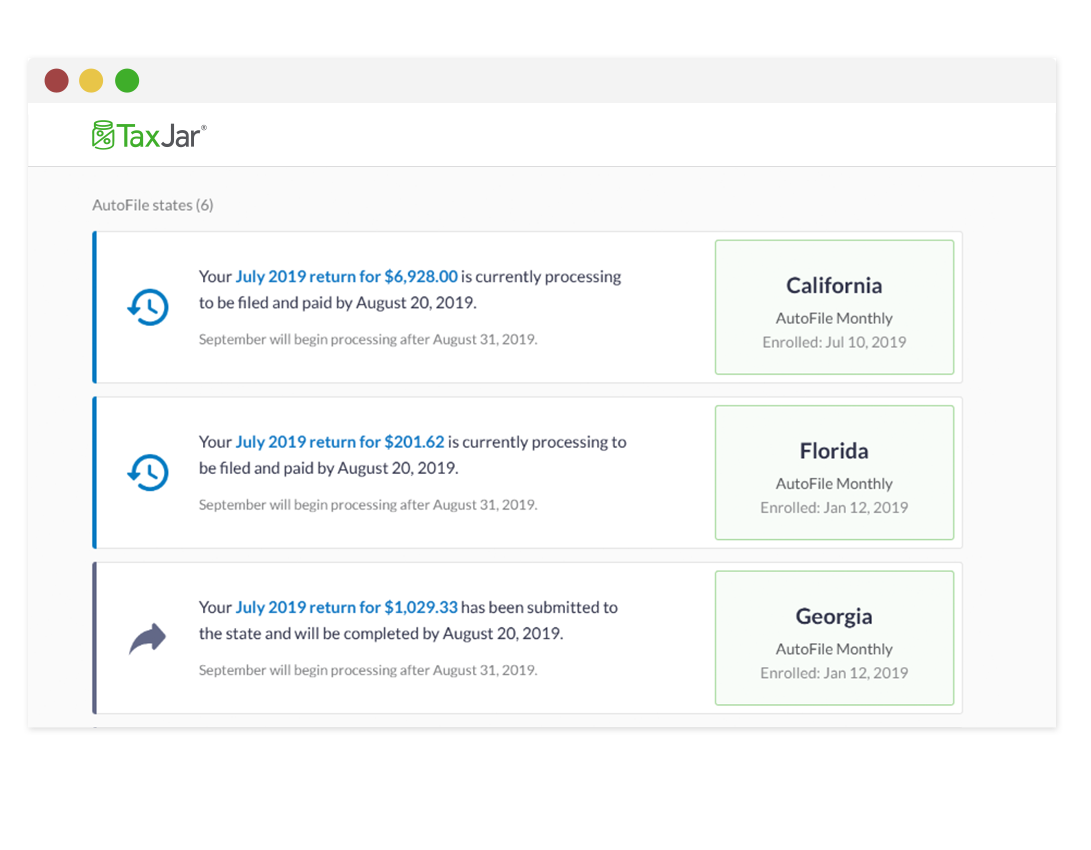

Learn more about TaxJar’s APICollect, report and file the right sales tax across every channel

TaxJar has built-in multi-channel support. No matter where and how you sell, we’ve got you covered. In addition, we can map any data from your e-commerce site to our tax codes so your sales tax reporting and filing is fully automated.

Learn more about our integrationsSeamless and scalable checkout experiences, tax included

Every millisecond matters in a checkout experience. TaxJar puts performance first - with a platform built for speed and scale — we process millions of transactions per hour and maintain 99.99% uptime. Sales tax calculation will never slow or break your checkout process, even on your busiest day.

Learn more about our reliability and availabilityTaxJar offers everything you need for Food & Beverage sales tax management

- Accuracy

- Performance & reliability

- Technology

- End-to-end customer experience