Manage the complexity of SaaS sales tax

Should you charge sales tax on your SaaS product? Some states consider your software a product and tax you like any other product. Others consider SaaS a service and don’t require you to collect.

There’s no one-size-fits all approach when it comes to charging sales tax. Get started by learning more about SaaS taxability state by state. With TaxJar:

- Know when and where you’re required to collect sales tax

- Get and stay sales tax compliant

- No tax bill surprises

Achieve growth with automated sales tax calculations

Sales tax rates change from state to state and even city to city. And the sales tax rate you charge depends on your customer’s billing address. With the TaxJar API you can assign a product tax code to all of your SaaS offerings, across any channel you use to sell — and eliminate headaches when you’re scaling quickly. With TaxJar's API:

- Charge the right amount of sales tax every time

- Avoid owing out of pocket

- Stay accurate and up-to-date on every sales tax rate

Future proof growth & customer experience

Get performance that is reliable and scalable for your SaaS business. Built on a foundation of automation and machine learning, TaxJar provides 99.99% uptime and lightning-fast response time for a seamless customer buying or upgrade experience.

We scale with you so you can provide your customers a reliable, scalable SaaS product that grows with them.

Learn more about our reliability and availability

We looked at other tools to automate tax collection, and there are some really great ones out there. But TaxJar was really a no brainer. Not only did it offer all the features we were looking for and genuinely excellent customer service, but the pricing model made the most sense for our business.”— DeAnna Swearingen, COO at Quimbee Read full case study

TaxJar offers everything you need for SaaS sales tax management

- Automatically calculated, accurate sales tax rates

- Pre-populated and maintained tax codes

- Economic nexus calculator

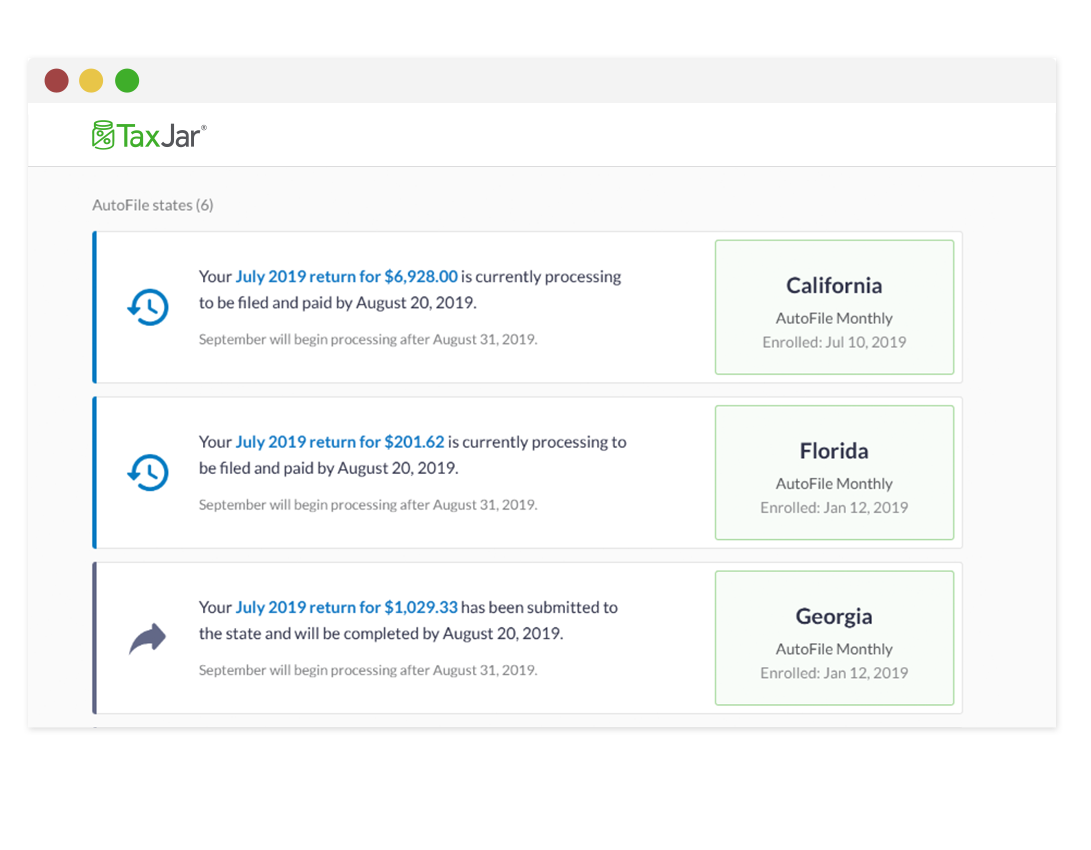

- Automated state filing