South Dakota v. Wayfair

The Supreme Court rules in favor of South Dakota

Watch Our Recorded Webinar

Webinar Panel Experts

What is happening

The Supreme Court just released its decision on the landmark sales tax case, South Dakota v. Wayfair.

What did the Supreme Court decide?

The Supreme Court ruled in favor of South Dakota on June 21st, 2018. Prior to this ruling, an online seller only had to collect sales tax from buyers in states where the online seller had a physical presence. This physical presence requirement was known as "sales tax nexus." By ruling in favor of South Dakota, The Supreme Court has decided physical presence is not required.

A brief history

Back in 2016, South Dakota passed a law requiring any online seller – whether they have nexus in the state or not – to collect South Dakota sales tax if they either made more than $100,000 in gross sales in the state in a calendar year, or made over 200 individual sales in the state each year. They followed this action up by suing Wayfair, Newegg and other eCommerce retailers who currently did not collect South Dakota sales tax.

How does this affect my business?

States are no longer bound by the concept of sales tax nexus. Instead, any state is allowed to require that an online seller who makes a sale into their state collect sales tax. This adds a significant sales tax compliance burden for online businesses. TaxJar is here to help reduce the complexity and stress by helping you automate your sales tax needs.

A landmark decision was made today regarding sales tax and how it affects eCommerce sellers.

If you’d like to read more about the case or if you’d like to ask questions on the ruling, we recommend you sign up for our upcoming webinar and join the conversation.

Given the substantial impact of this ruling, I’d like to weigh-in with some thoughts from TaxJar and how we’re thinking about the sales tax landscape ahead.

There are a lot of unknowns

Since the decision was announced, we’ve heard from a LOT of current and prospective customers. Big or small, every eCommerce business owner today is wondering how this new ruling is going to affect their business, and how they can get ahead of it.

And while we don’t have all of the answers to every question now, the one thing we can agree on, is that technology will be a key part of compliance.

View Your eCommerce Sales by State

Start automating sales tax with TaxJar

With the latest ruling of South Dakota v. Wayfair, online sellers will need to know how many sales and how much sales tax to remit for individual states. TaxJar automates that entire process for you in just a few clicks.

Instantly View Where You Meet Economic Nexus

Start a free trial and connect TaxJar to the places where you sell

We offer a simple one-click connection to your shopping carts and marketplaces. Once connected, we'll begin importing your sales data into TaxJar.

TaxJar needs all of your data to determine where your sales have exceeded economic thresholds in each state.

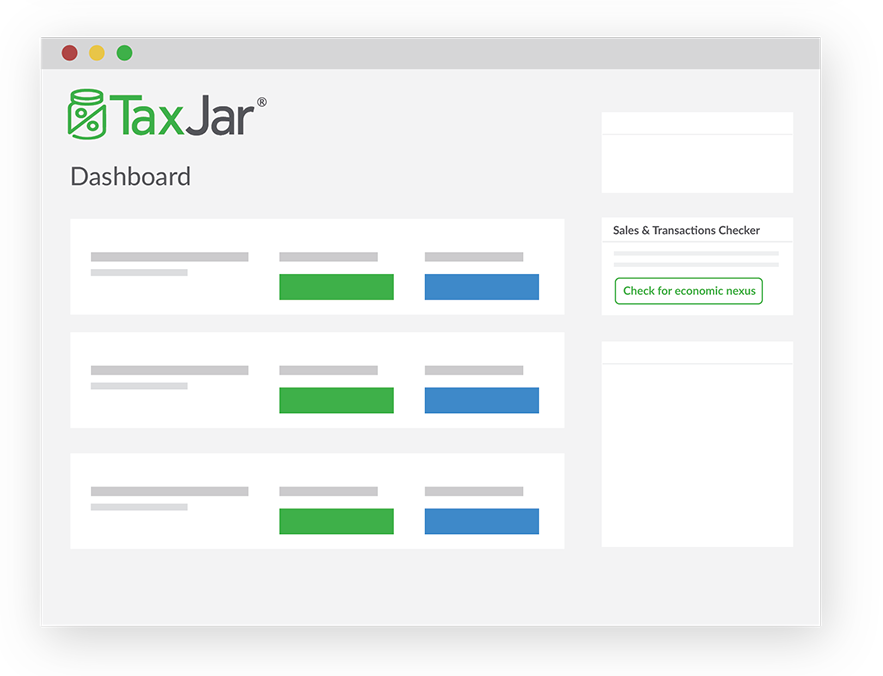

Find the Sales Tax & Transactions Checker on your dashboard

It's now time to begin the check. Find the button to begin on the top right of your TaxJar dashboard.

In just a few minutes, TaxJar will automatically summarize the number of transactions and the amount of revenue for each state where economic nexus and notice & report laws have been passed.

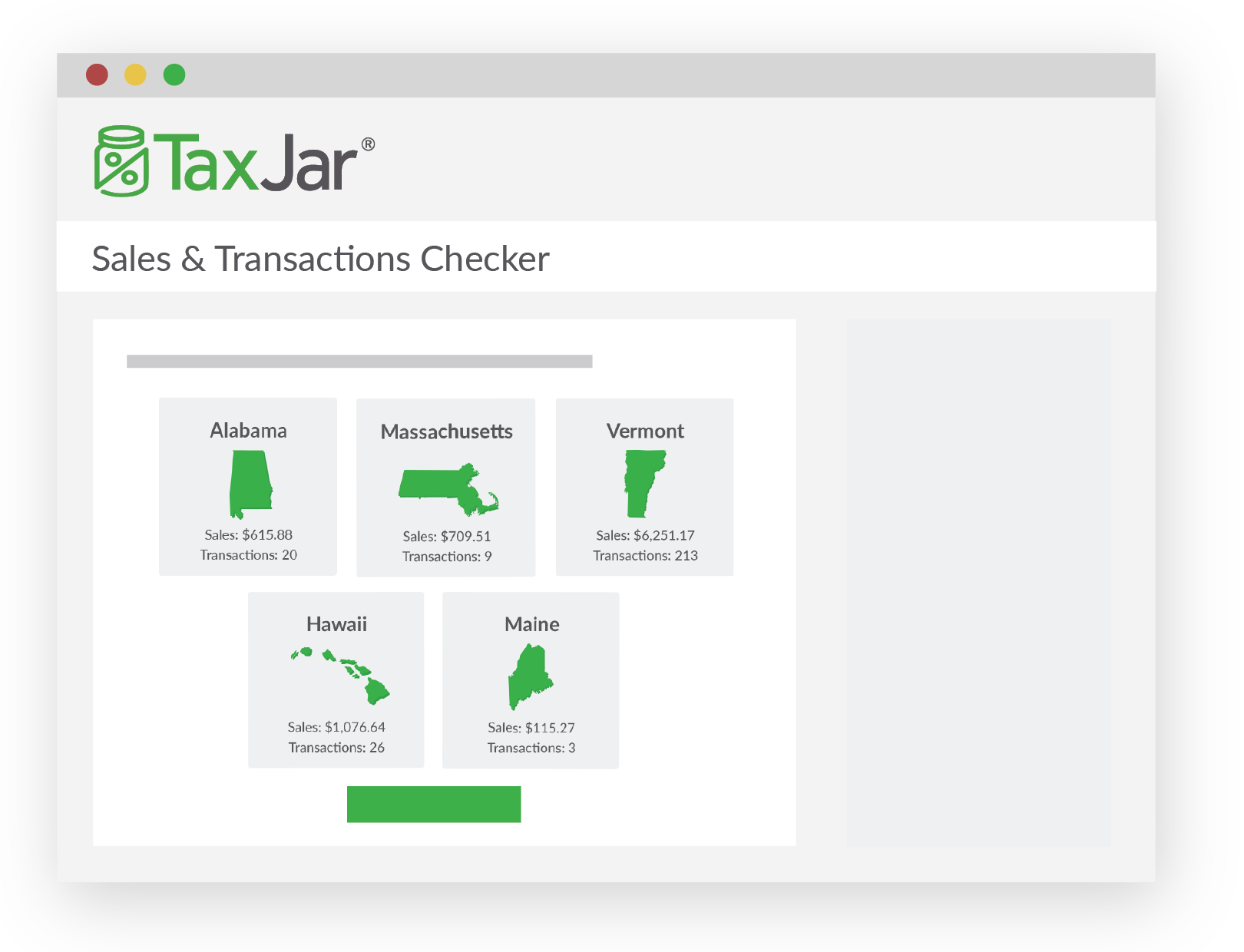

View your results

See a list of all of the states where your sales and/or transactions have exceeded that state's economic threshold. Read through our recommended steps on beginning to comply with sales tax in a new state.

Automate with TaxJar

Now that you've connected TaxJar to the places you sell, continue using your free trial to manage your sales tax and enroll in AutoFile.

Choose a TaxJar Plan That Fits Your Needs

Let TaxJar show you how to simplify sales tax. Join us today and find out how easy it can be.

Starter

For reporting and filing requirements.

Pricing varies based on order volume.

- Email support

- Simple CSV import

- Sales tax reporting

- 4 Free AutoFiles per year

TaxJar recommends

Professional

For sales tax automation and reporting needs.

Pricing varies based on order volume.

- All Starter features

- TaxJar API access & integrations

- Product tax code catalog

- AI product taxability categorization

- Phone support

- Advanced CSV import

- 12 free AutoFiles per year

Premium

A managed service for sales tax.

- All Professional features

- White glove support

- Custom tax research

- Unlimited AutoFiles

Don't Just Take Our Word for It, Browse More Than 200 Independent Reviews

TaxJar is the #1 sales tax automation software for eCommerce stores. More than 20,000 businesses and developers trust TaxJar to calculate sales tax for millions of transactions every month — and automate the filing of thousands of sales tax returns.

Common Questions

Feel free to contact us if you can't find the answer to your question. We're happy to help you.

From calculations to filing, TaxJar provides award-winning support and simple pricing options for businesses of all sizes.

For more information, please visit our pricing page.

No problem. We can connect to multiple eCommerce stores such as to Amazon, PayPal, Shopify and other shopping carts. If you use a cart we don’t integrate with, you can easily upload a .csv file of your transactions.

Economic nexus laws are passed by a state to require sales tax compliance in that state if a threshold in sales is met. For example, “If an online seller, even though they don’t have a presence in our state, makes more than $X in sales in our state, or conducts more than X number of transactions in our state, then they are required to collect sales tax from buyers in our state.”

Current state laws on economic nexus vary. The sales thresholds vary from $10,000 to $500,000 in sales, and some states don’t have a transaction threshold, at all.

Sure! Tell us what states you collect sales tax in and we’ll do the rest.

Yes. With AutoFile you can file sales tax returns in most states. Learn more about AutoFile.

Now that the decision is made and Quill has been overturned, the states are free to pursue sales tax from online retailers who exceed the thresholds as stated in their economic nexus laws. However, there’s also a chance that Congress could step in and pass a law regulating sales tax.

If you meet economic nexus thresholds in some states, we recommend speaking with a vetted sales tax expert to determine your course of action.