Save Hours on Squarespace Sales Tax Reporting & Filing

Eliminate the hassles of sales tax collection and reporting, and automate sales tax filing with TaxJar.

Features

How TaxJar for Squarespace Works

Generate Your API Key from the Settings Panel Inside Squarespace

All it takes is a few clicks to connect your Squarespace account from your TaxJar account. You only need to do this step once!

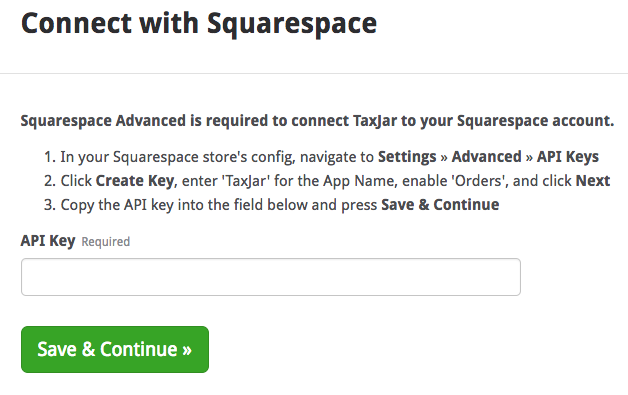

Enter Your Squarespace API Key into TaxJar

Complete the process by pasting your Squarespace API key into your TaxJar account.

Now we'll begin importing all of your Squarespace transactions into TaxJar and calculating how much sales tax you owe. You can save even more time by enrolling in TaxJar AutoFile as well.

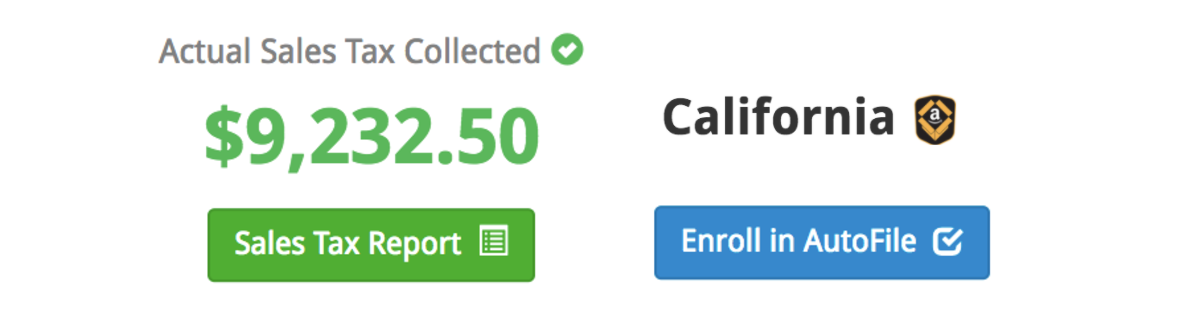

Your Sales Tax Reports are Prepared

Once you're synced up to TaxJar Reports, you'll see your sales tax collected by city and county, across all states where you collect sales tax. These get updated every day. Connect the other platforms on which you sell, and we'll update those daily, too.

Your TaxJar Reports dashboard will let you know if you're collecting enough sales tax and even when your returns are due. All you have to do now is file!

Enroll in AutoFile and Never File Again

All that's left to do now is take all the information we have broken down for you, and fill in the blanks on your sales tax forms!

Of course, if you want to make your life even easier, you could just let us do all the filing for you. With TaxJar AutoFile, we will automatically submit your tax forms for you when they are due. This is truly sales tax on autopilot.

Trusted by More Than 20,000 Customers

Fantastic Application. We're so happy to have found this app. It is an absolute must to keep your taxes under control. We're in California where sales tax is extremely confusing and complicated but TaxJar makes our lives easy.

It used to take me over two hours to file my tax return in Florida. With TaxJar it takes me 10 minutes.

This app is a MUST have for any business. Filing taxes is a nightmare and this app automates the entire process! I recommend that everyone uses this app because it will save you a ton of time and it makes filing state taxes effortless.

TaxJar ROCKS! Filing Sales Tax over several states and several platforms (Etsy, Shopify, Paypal, Square) usually took an hour or so to calculate. With TaxJar, it's already done. You sync your accounts, sales tax is calculated and beautifully broken down and it even tells you when it's due (helpful for filing in multiple states). When you efile, just fill in the blanks on the tax form and submit. It's the EASIEST thing in the world.

I spend a lot less time on sales tax now thanks to TaxJar.

Highly recommend. Just what I was looking for!

TaxJar provides a very simple service that saves me hundreds of dollars a year. Now I don't worry at all about filing my sales tax. Huge headache alleviated.

I'm a CPA and wouldn't think of running my business without TaxJar.

This app makes it easy to gather your taxable items in one place. It has great features that make it easy to pay taxes as well. Would recommend to anyone selling a taxable item.

Common Questions

Feel free to contact us if you can't find the answer to your question. We're happy to help you.

From calculations to filing, TaxJar provides award-winning support and simple pricing options for businesses of all sizes.

For more information, please visit our pricing page.

To use TaxJar, you'll need access to the Squarespace API which is only available to customers with Commerce Advanced plans. You can read more about Squarespace plans and learn how to upgrade your account here.

At this time we only provide support for filing and reporting Squarespace sales tax. You'll need to use the built-in tax rates that Squarespace provides to ensure you're collecting the right amount.

No problem. We can connect to multiple stores as well as to Amazon, PayPal, Walmart, Etsy and other marketplaces. If you use a cart we don't integrate with, you can easily upload a CSV file of your transactions.

Yes. With AutoFile you can file sales tax returns in most states. Learn more about AutoFile.